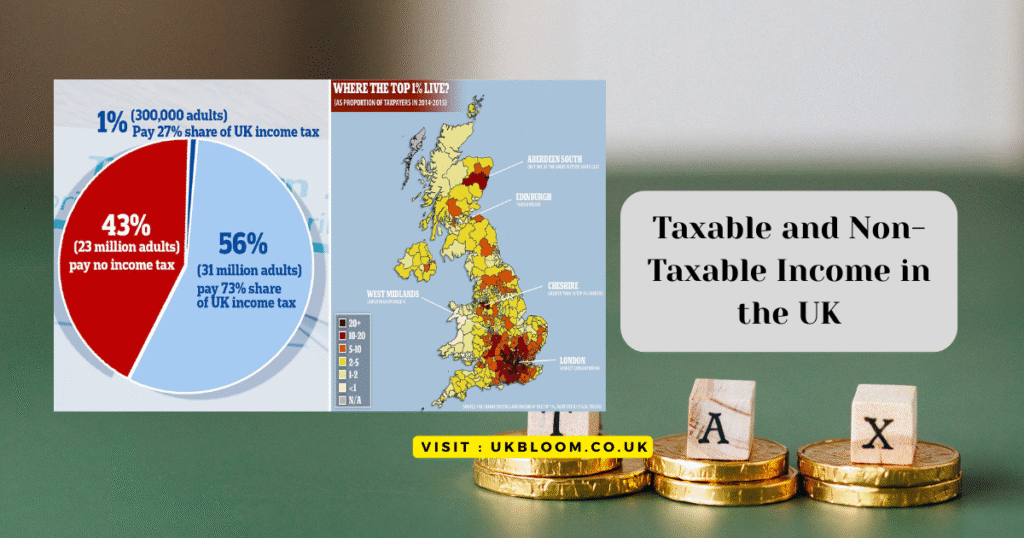

Taxable and Non-Taxable Income in the UK

Understanding which types of income are taxable in the UK is essential for accurate financial planning and tax compliance. HMRC has strict classifications that determine whether money you receive is subject to income tax or exempt.

Disclaimer: This article is for informational purposes only. Always consult the UK Home Office or a qualified tax adviser for personalized advice.

Table of Contents

What Counts as Taxable Income in the UK

Taxable income refers to any money or benefit you receive that is subject to income tax under UK law. HMRC assesses tax liability based on your total income during the tax year, including employment, pensions, rent, and more.

Employment Income

If you’re employed in the UK, nearly all earnings from your job are taxable, including:

- Salaries and wages

- Bonuses and commissions

- Overtime pay

- Tips and gratuities

- Reimbursed expenses not exempt under HMRC rules

- Company car or van benefit (BIK)

- Private medical insurance provided by employer

These earnings are taxed under PAYE (Pay As You Earn), where your employer deducts income tax and National Insurance before paying you.

Learn more: Taxable employment benefits

Self-Employment Income

Self-employed individuals must report all profits from their business or freelance work. Tax is paid on:

- Income from services or goods sold

- Consultancy fees

- Online sales or digital work (e.g. Etsy, Fiverr)

- Side hustles and gig economy jobs (e.g. Uber, Deliveroo)

Allowable business expenses can reduce your taxable profits. You must file a Self Assessment tax return annually.

More info: Self-employed income tax rules

Pensions and Retirement Income

The UK taxes most pension income, including:

- State Pension (if total income exceeds Personal Allowance)

- Private pensions

- Occupational or company pensions

- Annuities

- Drawdown income

25% of your pension pot may be withdrawn tax-free, but the rest is taxed at your marginal rate.

See: Tax on pensions

Savings and Investment Income

Taxable:

- Interest from savings accounts (after the Personal Savings Allowance)

- Dividends from shares (after the Dividend Allowance)

- Investment trust income

- Bond interest (except certain government bonds)

Allowances:

| Allowance | 2025/26 Limit |

|---|---|

| Personal Savings Allowance | £1,000 (basic rate) / £500 (higher rate) |

| Dividend Allowance | £500 per year |

Visit: Tax on savings and investments

Rental Income

Income from renting out property (residential or commercial) is fully taxable. You must declare:

- Rent payments

- Non-refundable deposits

- Cleaning fees paid by tenant

- Holiday let income (e.g. Airbnb)

Allowable expenses can offset tax: mortgage interest (limited), insurance, repairs, agent fees.

More: Property Income Tax Guide

Capital Gains

Profits from selling assets (property, shares, crypto, etc.) may be taxed under Capital Gains Tax (CGT). Applies if gains exceed the Annual Exempt Amount (£3,000 in 2025/26).

| Asset Type | Basic Rate | Higher Rate |

|---|---|---|

| Shares | 10% | 20% |

| Property | 18% | 28% |

You must report and pay CGT within 60 days if selling UK residential property.

More: Capital Gains Tax

State Benefits That Are Taxable

Some government benefits are taxable, including:

- State Pension (above Personal Allowance)

- Jobseeker’s Allowance (JSA)

- Carer’s Allowance

- Employment and Support Allowance (contributory)

- Bereavement Allowance

Tax is usually collected via Self Assessment or PAYE depending on other income sources.

Full list: Taxable state benefits

Non-Taxable Income in the UK

Not all income is taxable. Examples include:

- Certain government benefits

- Lottery and gambling winnings

- Gifts (not part of inheritance)

- Most scholarships and student loans

- Compensation for personal injuries

- Child Benefit (unless affected by High Income Child Benefit Charge)

Understanding exemptions can help you avoid overpaying tax.

Gifts and Inheritance

Gifts received are generally not taxable as income. However:

- Inheritance Tax (IHT) may apply on the donor’s estate if they die within 7 years of making large gifts.

- Gifts into trusts may also be taxable.

See: Inheritance Tax and gifts

Lottery Winnings and Gambling

All winnings from gambling, betting, or lotteries are tax-free in the UK, including:

- National Lottery

- Horse racing

- Casinos

- Online games and bingo

However, interest earned on invested winnings is taxable.

Child Benefit and Other Family Payments

Child Benefit is non-taxable unless your or your partner’s income exceeds £60,000, triggering the High Income Child Benefit Charge (HICBC).

Other tax-free family payments include:

- Maternity Allowance

- Sure Start Maternity Grant

- Guardian’s Allowance

More: Child Benefit and HICBC

Student Finance and Scholarships

These are not taxable:

- Tuition fee loans

- Maintenance loans

- University scholarships and bursaries

- Disabled Students’ Allowance

However, paid internships or grants linked to work may be taxed.

More: Student money and tax

Exempt State Benefits

The following benefits are not subject to tax:

- Universal Credit

- Disability Living Allowance (DLA)

- Personal Independence Payment (PIP)

- Attendance Allowance

- Winter Fuel Payment

- Housing Benefit

- Income Support

See full list: Tax-free state benefits

Foreign Income Rules

If you’re a UK tax resident, your worldwide income is taxable, including:

- Overseas salaries

- Foreign property income

- Dividends from non-UK companies

- Interest from offshore accounts

Non-residents pay tax only on UK-sourced income.

Check: Foreign income rules

Income from Trusts and Dividends

- Discretionary trusts may distribute income to beneficiaries, which is taxable at their marginal rate.

- Dividends above the Dividend Allowance (£500) are taxed at:

- 8.75% (basic)

- 33.75% (higher)

- 39.35% (additional)

More: Trust income tax rules

Reporting Requirements

You must declare taxable income using:

- PAYE for employed individuals

- Self Assessment for self-employed, landlords, or those with foreign income

- Report capital gains via HMRC within set deadlines

Late filing or incorrect declarations can result in fines and interest.

Guide: How to file your tax return

Internal Resources on UKBloom

- UK Income Tax Calculator

- Skilled Worker Visa Financial Requirements

- Cost of Living in the UK calculator

- Capital Gains Tax Guide for Expats

© This article is free to use with attribution. Reproduction without crediting UKBloom.co.uk will result in copyright violation.